Preguntas Frecuentes

Es una alternativa de inversión donde se integran los aportes de personas naturales y jurídicas (partícipes o aportantes) para su inversión en diversos valores y bienes que la ley permita.

Es administrado por una sociedad anónima por cuenta y riesgo de los aportantes, cuyas cuotas no son rescatables.

Los partícipes pueden ser instituciones financieras, fondos de pensiones o personas naturales.

Pueden ser públicos o privados, dependiendo de si hacen o no oferta pública de sus valores y en consecuencia están bajo la fiscalización de la Comisión para el Mercado Financiero. Éstos se rigen por la Ley N° 20.712 (LUF).

Los fondos mutuos están orientados a las personas naturales, que tiene como primer objetivo otorgar liquidez. Se permite el rescate total de las cuotas, y el pago de ellas no puede superar los 10 días.

Los fondos de inversión son menos líquidos, están orientados a la inversión en el mediano y largo plazo. El pago de las cuotas se hará después del décimo día, lo que va a depender de si es Rescatable o No Rescatable. El plazo específico estará estipulado en el Reglamento Interno del mismo fondo. A su vez, están orientados tanto a personas naturales como a inversionistas específicos (calificados).

Los fondos de inversión, además, cuentan con una fecha de definida de término (pudiendo ser prorrogable), mientras que los fondos mutuos no la tienen.

Los fondos de inversión públicos cuentan con Asamblea de Aportantes y Comités de Vigilancia, siendo ambos los organismos corporativos internos del fondo, teniendo diversas funciones y facultades que la ley les señala. Los fondos mutuos no cuentan con estos organismos corporativos al interior del fondo.

Fondos Privados

- Corresponde a aportes privados de personas o entidades, administrados por Administradoras de Fondos o por Sociedades Anónimas Cerradas, sin hacer oferta pública de valores ni estar sujetos a fiscalización por parte de la CMF.

- El número de aportantes no puede superar los 49 partícipes que no sean integrantes de una misma familia*. En caso de superar dicha cifra, éstos quedarán sujetos a las normas aplicables a los fondos fiscalizados por la CMF. También, debe contar con un mínimo de 8 aportantes no relacionados y cada uno de ellos no puede tener más del 20% del patrimonio del fondo. Esta última condición se invalida en el caso de que exista al menos un inversionista institucional que tenga a lo menos el 50% de las cuotas del fondo.

- Está prohibido hacer publicidad o promocionar públicamente información relativa a rentabilidades o inversiones de este tipo de fondos.

- Se rigen por sus reglamentos internos, por las normas del Capítulo V de la Ley N° 20.712 sobre Administración de Fondos de Terceros y Carteras Individuales, y el Capítulo IV de su Reglamento, el DS N° 129, del Ministerio de Hacienda.

Fondos Públicos

- Corresponde a fondos administrados por una sociedad anónima de giro exclusivo, llamada Administradora General de Fondos (AGF), que es fiscalizada por la CMF.

- Las cuotas de estos fondos constituyen valores de oferta pública que se registran en el Registro de Valores de la CMF y en las Bolsas de Valores.

- Debe contar con al menos 50 partícipes; en el caso de contar con un aportantes institucional (Fondo de Pensiones o Compañías de Seguro) no habrá un mínimo.

- Debe mantener un patrimonio permanente mayor a UF 10.000.

- Ningún aportante, salvo éste sea institucional, podrá tener más del 35% del patrimonio del fondo.

* Integrantes de una misma familia: quienes mantengan entre sí una relación de parentesco hasta el tercer grado de consanguinidad o afinidad y las entidades controladas, directa o indirectamente, por cada una de esas personas (Ley N°20.712)

Hay dos tipos de fondos de inversión, los rescatables y los no rescatables

Fondos No Rescatables

- No permiten a los aportantes el rescate total y permanente de sus cuotas, o si lo permiten, pagan a sus aportantes las cuotas rescatadas en un plazo igual o superior a 180 días.

- Los aportes quedan expresados en cuotas y deben registrarse obligatoriamente en una bolsa de valores chilena o del extranjero, autorizada por la CMF, para permitir la formación de un mercado secundario para la compra y venta de dichas cuotas.

- Deberán contar con un Comité de Vigilancia, compuesto por un número impar de aportantes del fondo, y realizar Asambleas Ordinarias, una vez al año dentro de los primeros 5 meses desde el cierre del año, y/o Extraordinarias.

Fondos Rescatables

- Permiten a los aportantes el rescate total y permanente de cuotas, realizando el pago de éstas entre 11 y 179 días a partir de la solicitud.

- Los aportes quedan expresados en cuotas del fondo, pudiendo existir distintas series de estas para un mismo fondo, lo que deberá establecerse en el reglamento interno respectivo.

- Las cuotas de un fondo o de sus series, deberán tener igual valor y características, y su cesión se regirá por las formalidades y procedimientos que establece el reglamento interno del fondo.

- Las cuotas de una serie de un fondo podrán ser canjeadas por cuotas de otra serie del mismo fondo, rigiéndose por las normas que se establecen al respecto en el reglamento interno.

Tanto en los fondos públicos como en los fondos privados, la inversión de los recursos del fondo puede efectuarse en todo tipo de instrumentos, contratos o bienes, salvo que no podrán invertir directamente en algunos activos* ni desarrollar directamente ciertas actividades** de acuerdo a la Ley.

La información debe estar contenida en el Reglamento Interno del fondo.

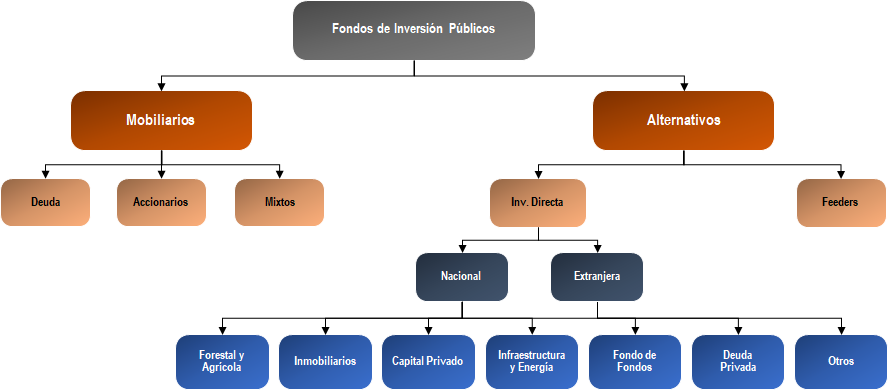

ACAFI generó una clasificación interna de los fondos, de modo de hacer más fácil la identificación de los mismos.

*Activos tales como: bienes raíces, pertenencias mineras, derechos de agua, derechos de propiedad industrial o intelectual y vehículos de cualquier clase.

**Actividades tales como: industriales, comerciales, inmobiliarias, agrícolas, de minería, exploración, explotación o extracción de bienes de cualquier tipo, de intermediación, de seguro, reaseguro o cualquier otro emprendimiento o negocio que implique el desarrollo directo de una actividad comercial, profesional, industrial o de construcción por parte del fondo y, en general, de cualquier actividad desarrollada directamente por éste distinta de la de inversión y sus actividades complementarias.

Una cuota de un fondo corresponde a una porción del patrimonio del mismo. A cada una de estas cuotas se les asigna un valor inicial, que irá variando en el tiempo, y será la base para calcular la rentabilidad obtenida al final del periodo.

Todos los aportes quedan expresados en cuotas del fondo, el que puede tener distintas series de cuotas de acuerdo a sus características. Se diferencian principalmente por la estructura de costos asociada.

Las cuotas de una serie de un fondo podrán ser canjeadas por cuotas de otra serie del mismo fondo, rigiéndose por las normas que se establecen al respecto en el Reglamento Interno

En un fondo público no rescatable, las cuotas deben registrarse obligatoriamente en una bolsa de valores chilena o del extranjero, autorizada por la CMF, para permitir la formación de un mercado secundario para la compra y venta de dichas cuotas.

La comisión de administración del fondo, conocida como “remuneración”, es fija por serie y puede considerar además una comisión variable. Esta última puede atribuirse a los resultados del fondo, al rescate de cuotas, al proceso de liquidación del fondo, entre otros.

A su vez, hay gastos que son con cargo al fondo, corresponden a gastos administrativos y operacionales incurridos durante la duración del fondo

Tanto las comisiones como los gastos del fondo deben venir especificados en el Reglamento Interno del mismo.

Cabe destacar, que si la compra de cuotas se efectúa a través de un tercero, éste cobrará una comisión por dicha gestión

El TAC, tasa anual de costos, es un indicador que se presenta en los folletos informativos de los fondos, que sirve para comparar entre fondos y tomar mejores decisiones de inversión.

Se calcula como la suma de cada resultado al dividir los costos asociados al fondo o serie sobre el patrimonio diariamente, durante el último año.

Generalmente se presenta junto a

- “TAC Industria”, que representa el promedio de los TAC de todos los fondos del mismo tipo y moneda de la industria.

- “TAC mínimo”, es el TAC más bajo de los fondos del mismo tipo y moneda de la misma administradora.

- “TAC máximo”, es el TAC más alto de los fondos del mismo tipo y moneda de la misma administradora.

Antes de invertir en cualquier vehículo financiero, el futuro inversionista deberá definir su perfil de riesgo. Para ello, debe determinar:

- El horizonte de tiempo de la inversión

- Los ingresos que esperaría obtener

- Las obligaciones financieras que tendrá dentro del periodo

- Cuál es su tolerancia al riesgo

- Conocimiento del activo en que se invertirá y los efectos de la economía en dicho activo, entre otros.

Una vez, revisado el Reglamento Interno del fondo, la compra de cuotas se puede efectuar directamente en la Administradora General de Fondos (AGF) o bien a través de un tercero, como podría ser una corredora de bolsa.

¿Cuáles son las características clave a revisar para realizar la inversión?

- Comisiones (variables y fijas del fondo)

- Si es rescatable o no rescatable

- Duración del fondo y sus renovaciones

- Condiciones y plazos de liquidación

- Objeto del fondo y política de inversión

- Política de reparto de beneficios

El listado de fondos de inversión vigentes se puede encontrar aquí

Las príncipes leyes y normas que regulan la industria serían las señaladas a continuación:

- Ley número 20.712 sobre Administración de Fondos de Terceros y Carteras Individuales.

- Decreto Supremo número 129, Reglamento sobre Administración de Fondos de Terceros y Carteras Individuales.

- Ley número 18.046 sobre Sociedades Anónimas.

- Decreto Supremo número 702, Reglamento sobre Sociedades Anónimas.

- Norma de Carácter General número 30 de la Comisión para el Mercado Financiero

- Norma de Carácter General número 365 de la Comisión para el Mercado Financiero, la cual establece contenidos mínimos de Reglamentos y textos de contratos de Fondos, regular procedimiento de depósito e imparte instrucciones respecto a las modificaciones introducidas a los antecedentes depositados.

- Oficio Circular número 1997 y número 1998, y Norma de Carácter General número 431, todos de la Comisión para el Mercado Financiero, los cuales imparten instrucciones sobre presentación de información financiera bajo IFRS, para Fondos Mutuos y Fondos de Inversión, respectivamente.

Los Fondos de Inversión Privado se regirán exclusivamente por las disposiciones contenidas en sus reglamentos internos y por las normas del capítulo V de la Ley 20.712 sobre Administración de Fondos de Terceros y Carteras Individuales, y los artículos 57 y 80 de ésta misma.

Establece los lineamientos generales y específicos bajo los cuales se regirá cada fondo de inversión, estableciendo los elementos de resguardo que garantizan que la administradora gestionará cada fondo atendiendo exclusivamente a la mejor conveniencia de sus aportantes.

Fuente: Comisión para el Mercado Financiero (CMF).

Todos los fondos de inversión que tengan gobierno corporativo propio, deben realizar asambleas con el objetivo de tratar todos los temas que puedan afectar los intereses de los aportantes del fondo de inversión, además de acordar condiciones para la operación de este.

Corresponde a dichas asambleas aprobar los estados financieros de los fondos, como también aprobar la introducción de modificaciones a sus reglamentos internos, o aumentos y disminuciones de su capital, entre otras materias.

Fuente: Comisión para el Mercado Financiero (CMF).

Para los fondos de inversión no rescatables, la Ley Única de Fondos contempla la obligación de establecer un Comité de Vigilancia, el cual tiene atribuciones que buscan garantizar el cumplimiento del reglamento interno del fondo, junto con otras facultades de fiscalización tendientes a resguardar los intereses de los aportantes.

Fuente: Comisión para el Mercado Financiero (CMF).

Asociación Chilena Administradoras de Fondos de Inversión

Isidora Goyenechea 2939, Piso 16, Santiago, Región Metropolitana

+56223788998

acafi@acafi.com